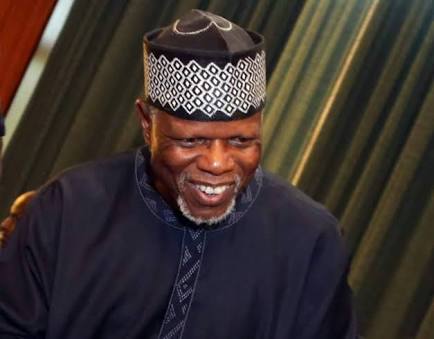

Col. Hameed Ibrahim Ali (retd), the Comptroller-General of Customs, was obviously absent yesterday at the Senate’s one day public hearing on the repeal of Customs and Excise Management Bill.

Ali was invited alongside other stakeholders to be part of the public hearing, just as the Senate President, Bukola Saraki, was said to have frowned on his absence when the Minister of Works, Housing and Power, Babatunde Fashola, other Chief Executive Officers honoured the Senate to attend public hearings.

But the Customs boss failed to come for such a very germane and facts-finding hearing to build the country.

This is just as the Senate has vowed to repeal the 54-year-old law establishing the Customs, which the Senate described as not only obsolete, but also fraught with loopholes for revenue leakages.

Declaring open the public hearing, Senate President, Bukola Saraki, who said the nation must get it right by ensuring that Customs did what it ought to do as a revenue generating agency, stressed that some of the laws guiding the agency’s operation were already outdated and due for a repeal.

The public hearing was on the bill on Customs and Excise Management Act (Repeal and Re-enactment) 2016.

Saraki urged the Senator Hope Uzodinma-led Committee on Customs, Excise and Tariff to hasten its job, saying the Senate would pass the Bill before the lawmakers go on recess.

Saraki said: “The 8th Senate is determined to ensure that no stone is left unturned in ensuring that the Customs and Excise department plays the pivotal role it is expected to play as a major funder of the federal budget.

‘’It is for this reason that we waste no time in assigning the proposed bill to the Committee on Customs and Excise for immediate action.

“It is for the very critical role that the Custom plays in the economic and security life of our country that we have made this bill one of our key priority bills.

“The Customs remains one of the most important sources of government revenues. With government revenues dwindling rapidly at a time when we have so much to do, this has further made the need for us to block all leakages and possible inefficiency points in our revenue profile an urgent national duty.’’